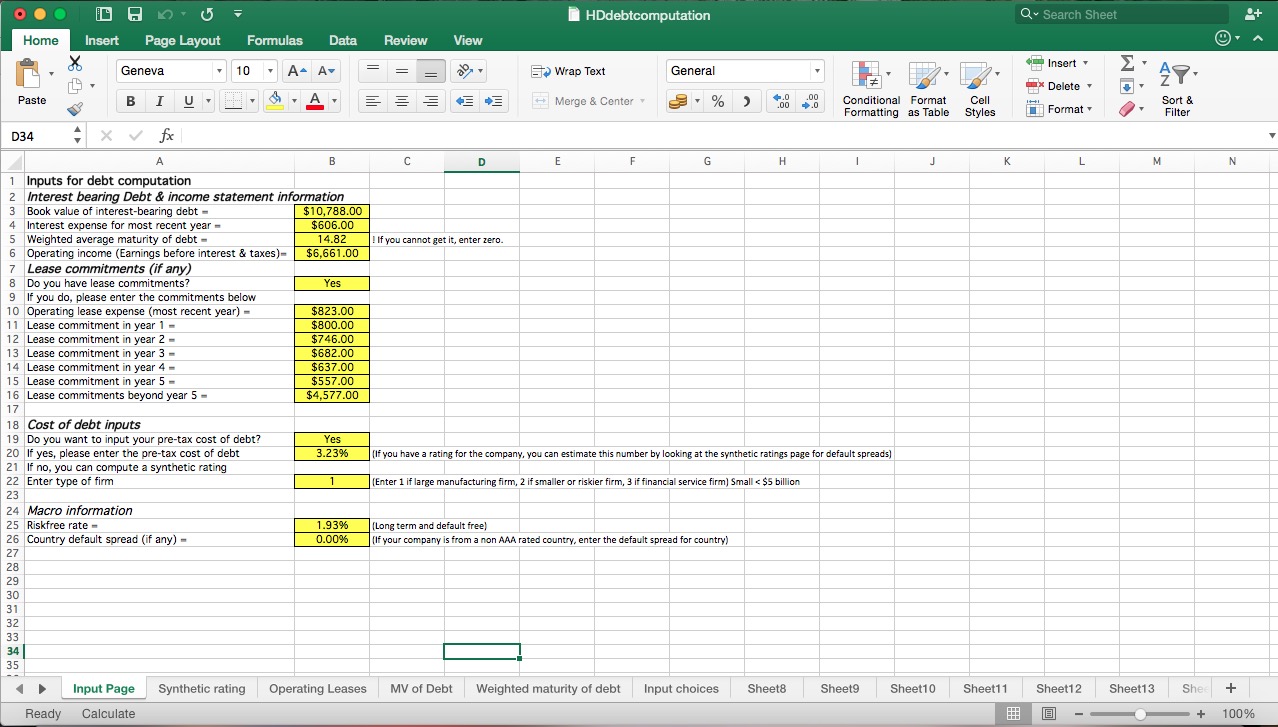

SOLVED: A firm has current assets that could be sold for their book value of 14 million. The book value of its fixed assets is52 million, but they could be sold for

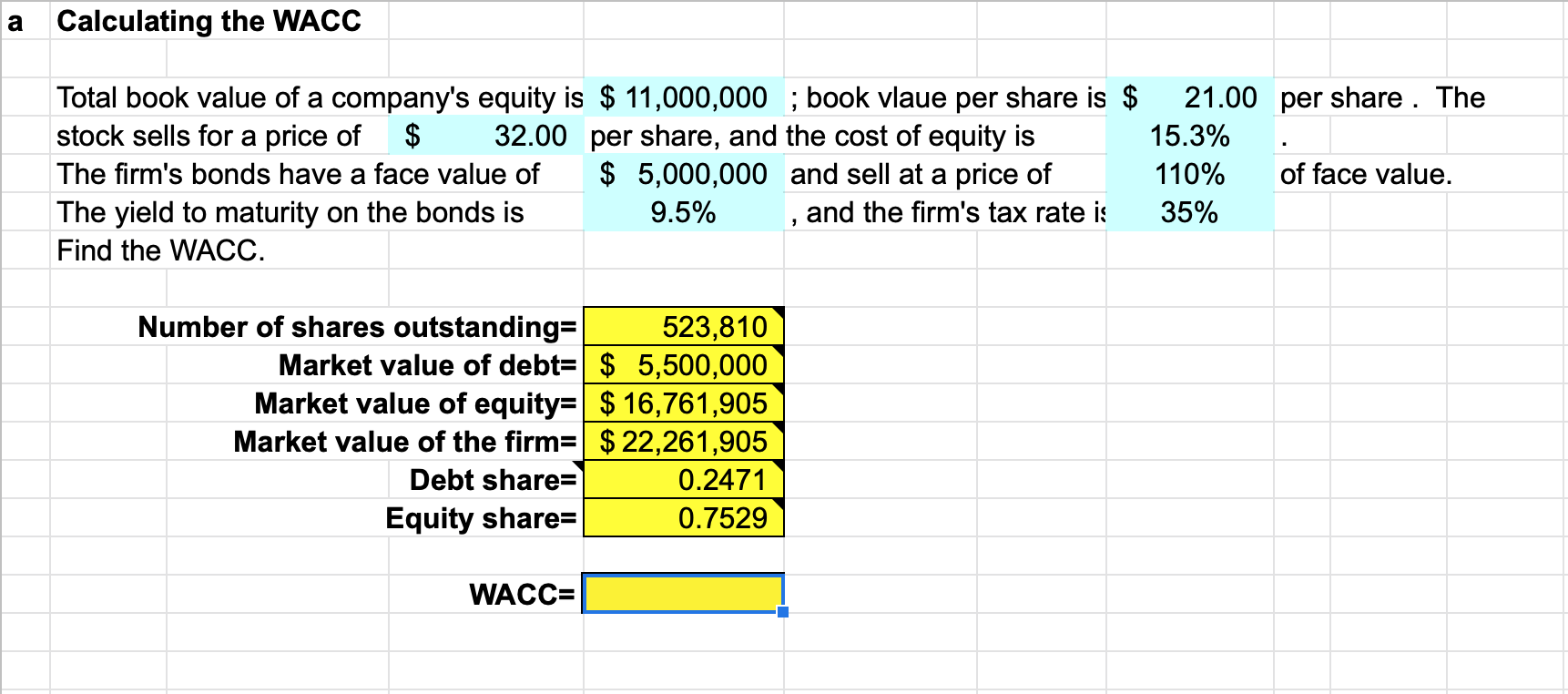

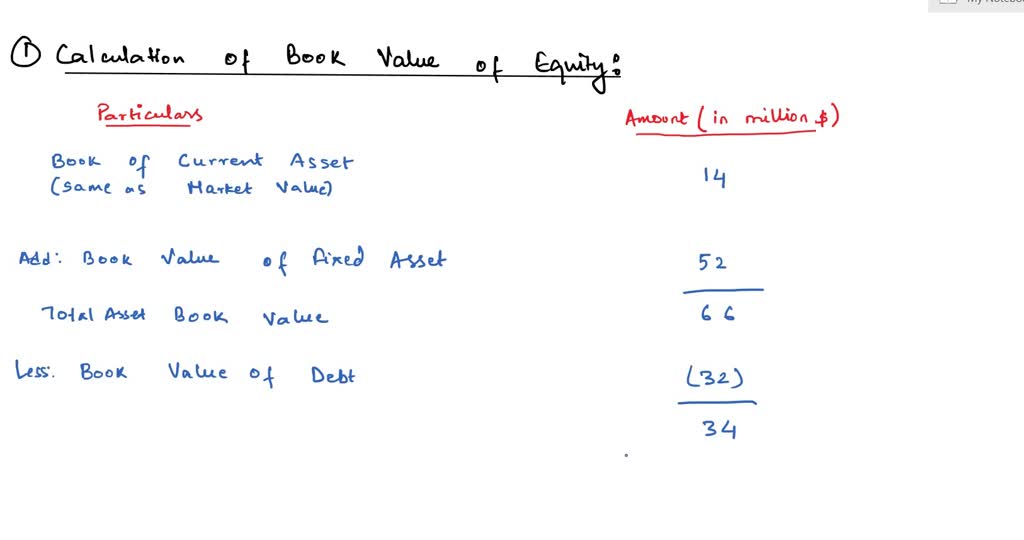

SOLVED: Weighted Average Cost of Capital 1) Given the information below, what is the WACC of this company? (1.5 points) Market Value of Equity Market Value of Debt Cost of Equity Cost

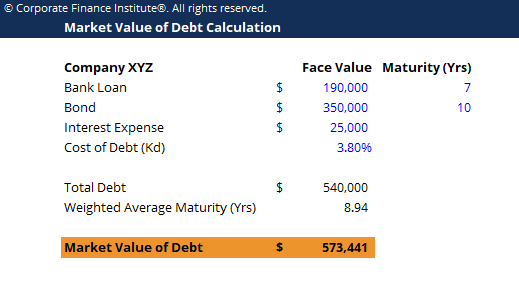

![Market Value Of Debt - [ Definition, Formula Calculation, Example ] - Guide Market Value Of Debt - [ Definition, Formula Calculation, Example ] - Guide](https://www.stockmaster.com/wp-content/uploads/2020/02/market-value-of-debt.jpg)

:max_bytes(150000):strip_icc()/CocaColaCosolidatedBalanceSheetEquitysection-3273a93cd44844e5b578a8fd2f76d115.jpg)

:max_bytes(150000):strip_icc()/book-value-99796d4d1fb44bd4bdc961e6042698d7.jpg)